App.edulnmu.com – Xiaomi 12 Lite 5G telah resmi dirilis di Indonesia pada hari Selasa (19 Juli 2022). Di dalam negeri, seri flagship Xiaomi 12 Lite 5G versi ini lebih murah dibanderol Rp 5,8 juta dalam varian 8 GB/256 GB. Harganya tidak jauh berbeda dengan ponsel sub-brand Xiaomi Poco. Awal Juli ini, Poco juga merilis ponsel Poco F4 5G dengan harga Rp5,7 juta (8/256 GB).

Apa perbedaan spesifikasi Xiaomi 12 Lite 5G Indonesia dengan Poco F4 5G hanya dengan selisih Rp100.000? Untuk ukuran layar dan spesifikasi kedua flagship ini, Poco F4 dan Xiaomi 12 Lite 5G kompak dengan panel AMOLED. Perbedaan utama terletak pada ukuran layar. Layar Poco F4 berukuran 6,67 inci. Layar Xiaomi 12 Lite memiliki bentang kecil 6,55 inci.

Perbedaan lainnya ada pada touch sampling rate dan kecerahan layar. Layar Poco F4 lebih unggul dari Xiaomi 12 Lite karena mendukung touch sampling rate 360 Hz dan dapat menampilkan gambar dengan tingkat kecerahan hingga 1300 nits. Tingkat pengambilan sampel sentuh layar Xiaomi 12 Lite ditetapkan pada 240Hz dan tingkat kecerahan 950 nits. Layar Xiaomi 12 Lite dan Poco F4 juga memiliki kesamaan. Misalnya, kedua perangkat kompak mendukung resolusi Full HD Plus (2.400 x 1.080 piksel), kecepatan refresh 120 Hz, dan dilindungi oleh Corning Gorilla Glass 5.

Tombol Fingerprint Yang Berbeda

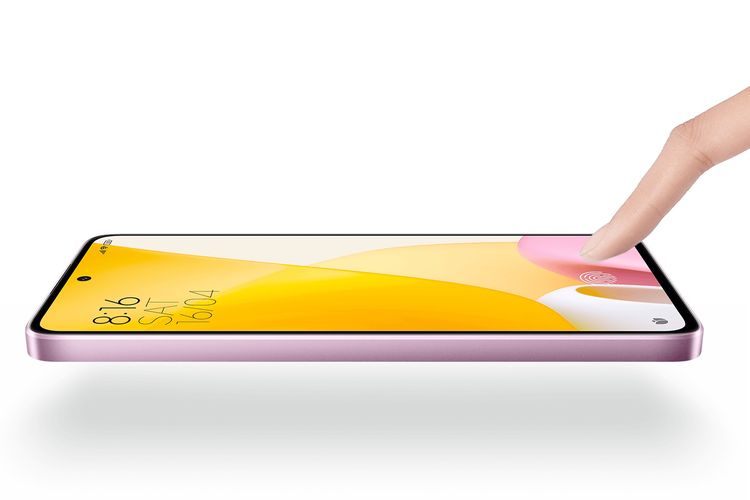

Salah satu keunggulan layar AMOLED Xiaomi 12 Lite adalah memiliki pemindai sidik jari dibagian layar (bawah). Fitur ini biasa digunakan pada ponsel kelas atas dan kelas atas (flagship), sehingga sidik jari di bagian bawah layar juga dapat membuat ponsel Anda terlihat lebih premium. Poco F4 menyertakan pemindai sidik jari yang terintegrasi dengan tombol daya.

Model sidik jari ini sebenarnya banyak ditemukan di ponsel kelas menengah. Kamera utama 108MP dan 64MP Xiaomi 12 Lite dan compact Poco F4, yang dijual dengan harga yang hampir sama, memiliki tiga kamera belakang. Namun dengan selisih harga hanya Rp100.000, Xiaomi 12 Lite sudah menawarkan kamera utama beresolusi tinggi 108MP.

Poco F4 memiliki kamera utama 64MP. Dua kamera belakang pada dua ponsel lainnya sama persis. Dengan kata lain, ini adalah kamera ultra lebar 8MP dan kamera makro 2MP. Untuk kamera depan, Xiaomi 12 Lite dibekali kamera selfie 32MP dan Poco F4 dilengkapi kamera selfie 20MP. Kedua ponsel 5G yang dibanderol Rp5 juta itu sama-sama membenamkan kamera selfie-nya di lubang punch hole.

Beda “otak” Perbedaan lain terletak pada “otak”, juga dikenal dengan chipset. Xiaomi dibekali dengan chipset Qualcomm Snapdragon 778G pada Xiaomi 12 Lite. Poco F4 memiliki chipset Qualcomm Snapdragon 870, namun kenyataannya kedua chipset tersebut dirilis pada tahun 2021. Bedanya, Snapdragon 778G dibangun dengan manufaktur 6nm dan menggunakan prosesor (CPU) Kryo 670 dengan kecepatan clock. 2.4 Ghz dan prosesor grafis (GPU). Adreno 642L. Chipset Snapdragon 870 menggunakan CPU Kryo585 dengan kecepatan clock 3.2GHz dan GPU Adreno 650, dan dibangun dengan manufaktur 7nm.

Kapasitas Baterai Yang Berbeda

Di sektor daya, Xiaomi 12 Lite memiliki baterai 4.300mAh. Kapasitasnya sedikit lebih kecil dari baterai Poco F4 4.500mAh. Kedua ponsel kompak 5G ini mendukung fitur pengisian cepat 67 watt. Menurut Xiaomi, pengisian cepat 67 watt yang disertakan dengan 12 Lite dapat mengisi baterai dari 0 hingga 50 persen hanya dalam 15 menit. Atau sepenuhnya 100% dalam waktu 30 menit.

Sementara itu, Poco mengklaim bahwa pengisian cepat 67 watt dapat mengisi baterai Poco F4 hingga 100% hanya dalam waktu 38 menit. Kapasitas baterainya juga lebih besar dari Xiaomi 12 Lite, sehingga Poco F4, yang membutuhkan waktu lama untuk mengisi daya, sangat wajar.

Beragam Pilihan Memori Internal dan Harga Di Indonesia

Xiaomi 12 Lite hanya tersedia dengan kapasitas 8/256GB yang menjadi salah satu pilihan untuk RAM dan media penyimpanan. RAM ponsel dapat diperluas sementara dengan “meminjam” beberapa penyimpanan internal hingga 3GB. Memungkinkan pemilik Xiaomi 12 Lite untuk menggunakan hingga 11GB RAM.

Berbeda dengan Xiaomi 12 Lite, Poco F4 dibanderol dengan dua pilihan RAM dan media penyimpanan: 6/128GB dan 8/256GB. Poco F4 memiliki fungsionalitas peningkatan RAM 2GB dan 3GB.

Harga Poco F4 dengan varian RAM 6GB Bisa Tambah Hingga 2GB. Oleh karena itu, total RAM yang tersedia hingga 8GB. Dengan varian RAM 8GB, Poco F4 bisa tumbuh hingga 3GB. Oleh karena itu, total RAM yang tersedia hingga 11GB.

Untuk harga, berikut perbandingan harga Xiaomi 12 Lite 5G dan Poco F4 5G Indonesia:

- Xiaomi 12 Lite (8/256 GB) – Harga Rp 5,8 juta

- Poco F4 5,8 Juta (8/256 GB) – Harga Rp. 5,7 Juta

- Poco F4 (6/128 GB) – Harga Rp5,2 Juta

Spesifikasi Xiaomi 12 Lite dan Poco F4

Ponsel Mana Yang Dipilih Setelah Mengetahui Perbedaannya?

Untuk informasi lebih lanjut, kami membandingkan spesifikasi Xiaomi 12 Lite dan Poco F4, jadi aman untuk membeli ponsel baru.

| Spesifikasi | Xiaomi 12 Lite 5G | Poco F4 5G |

| Layar | AMOLED 5 inci, resolusi Full HD Plus (2.400 x 1.080 piksel), kecepatan refresh 120 Hz, kecepatan pengambilan sampel sentuh 240 Hz, tingkat kecerahan 950 nit, Dolby Vision, HDR10 +, Gorilla Glass 5 | AMOLED, resolusi Full HD Plus (2.400 x 1.080 piksel), kecepatan refresh 120 Hz, kecepatan sampling sentuh 360 Hz, Dolby Vision, kecerahan hingga 1300 rajutan, Corning Gorilla Glass 5 |

| Desain | Dimensi: 159,3 × 73,7 × 7,29 mm, Berat: 173 g | Dimensi: 59,3 x 73,7 x 7,29 mm, Berat: 173 g Dimensi: 163.2 x 75.95 x 7.7mm Berat: 195 g |

| Warna |

Black, Lite Green dan Lite Pink

|

Moonlight Silver, Night Black dan Nebula Green

|

| Chipset | Qualcomm Snapdragon 778G (6 nm) CPU: Kryo670 hingga 2.4GHz GPU: Adreno 642L | Qualcomm Snapdragon 870 (7 nm) CPU: Octa core speed hingga 3.2GHz GPU: Adreno650 modem X55 5G |

| Penyimpanan |

8 GB+256 GB

LPDDR5+ UFS 2.2

|

6 GB+128 GB | 8 GB+256 GB

LPDDR5+ UFS 3.1

|

| Kamera Belakang | 108 MP, f/1.9, 26mm (wide), 1/1.52″, 0.7µm, PDAF 8 MP, f/2.2, 120˚ (ultrawide), 1/4.0″, 1.12µm 2 MP, f/2.4, (macro) Dual-LED dual-tone flash, HDR, panorama 4K@30fps, 1080p@30/60/120fps; gyro-EIS |

64 MP, f/1.8, (wide) 1/2.0″, 0.7µm, PDAF, OIS 8 MP, f/2.2, 119˚ (ultrawide), 1/4.0″, 1.12µm 2 MP, f/2.4, (macro) LED flash, HDR, panorama 4K@30/60fps, 1080p@30/60fps |

| Kamera Depan | 32 MP, f/2.5, (wide), 1/2.8″, 0.8µm, AF HDR, panorama 1080p@30/60fps, 720p@120fps |

20 MP, f/2.5, (wide), 1/3.06″, 1.0µm 1080p@30fps |

| Baterai & Pengisian Daya | Li-Po 4300 mAh, non-removable Fast charging 67W, 50% in 13 min (advertised) Quick Charge 4+ Power Delivery 3.0 |

Li-Po 4500 mAh, non-removable Fast charging 67W, 50% in 38 min (advertised) Quick Charge 3.0 Power Delivery 3+ |

| Jaringan & Konektivitas | GSM / HSPA / LTE / 5G | GSM / HSPA / LTE / 5G |

| Harga | Rp. 5,799.000 | Rp. 5,199.000 – Rp. 5,699.000 |

Demikianlah sekilas perbandingan ponsel dari Xiaomi 12 Lite 55 dengan Poco F4 5G, semoga bermanfaat dan bisa menjadi rekomendasi tips pertimbangan sebelum membeli ponsel idaman Anda.